Our three-part series is a guide to the key things you need to know about how to manage the Capital Gains Tax (CGT) discount for Temporary & Foreign Residents. The guide covers foundational terminology, how net capital gain or loss is calculated and how the CGT discount is applied.

If you missed Part 1, you can read it here

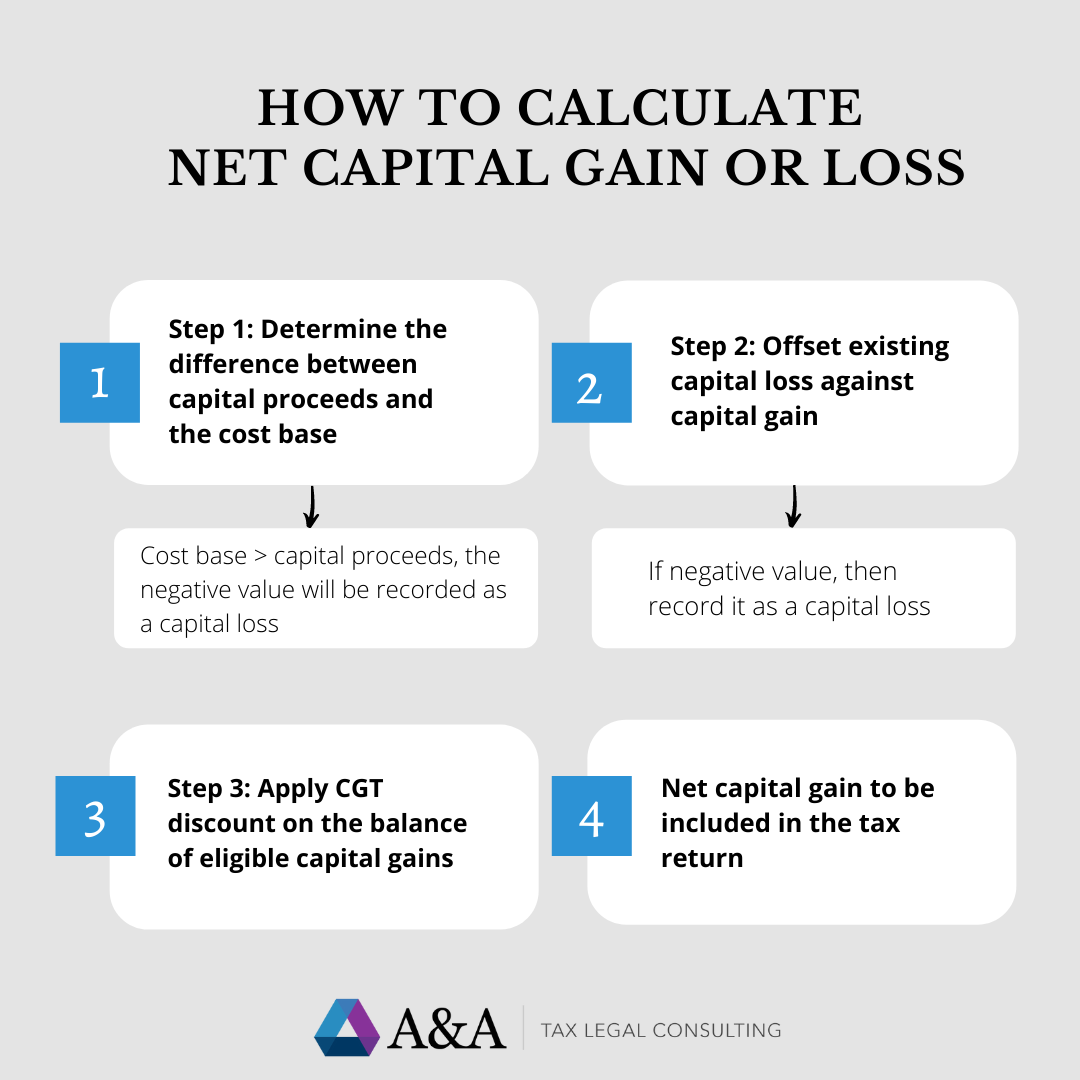

Part 2 of 3: Learning how to calculate net capital gain or loss

There are a number of steps taken to determine how to calculate net capital gain or loss.

Step 1

Firstly, capital gain or loss is usually determined by taking the difference between the cost to acquire the asset and the proceeds from the CGT event.

- If the capital proceed is more than the cost base of the asset, it is a capital gain.

- If the capital proceed is less than the cost base of the asset, it is a capital loss.

This step is to be repeated for each capital asset you have sold in the tax year.

Step 2

If there is any capital loss carried forward or incurred during the year, the capital loss will have to be offset against the capital gain. Please note that the carried forward capital loss must be subtracted till zero before utilising the current year capital loss.

The capital loss will be applied against the short-term capital gain before long-term capital gain as this will provide lowest CGT amount.

If the remaining value is negative, this is a capital loss to be recorded in your income tax return. If the remaining value is positive, please proceed to Step 3.

Step 3

If the capital gain is derived from the asset is hold for at least 12 months before the CGT event, the capital gain is eligible for a CGT discount under Subdivision 115 of ITAA 1997.

CGT discount percentage for individual is limited to 50%. The discount percentage will be lower if you are a foreign or temporary resident for Australian tax purpose during any period while you are holding the CGT asset.

Part 1

+61 3 9939 4488