Our three-part series is a guide to the key things you need to know about how to manage the Capital Gains Tax (CGT) discount for Temporary & Foreign Residents. The guide covers foundational terminology, how net capital gain or loss is calculated and how the CGT discount is applied.

If you missed Part 1, you can read it here If you missed Part 2, you can read it here

Part 3 of 3: Understanding whether the CGT Discount for Temporary & Foreign Residents applies to you.

The key date to keep in mind when considering the CGT discount rule is 8 May 2012 as there were significant changes made at this time, including:

- Full discounts available for asset obtained and disposed before 8 May 2012;

- No discount available for asset obtained and disposed after 8 May 2012;

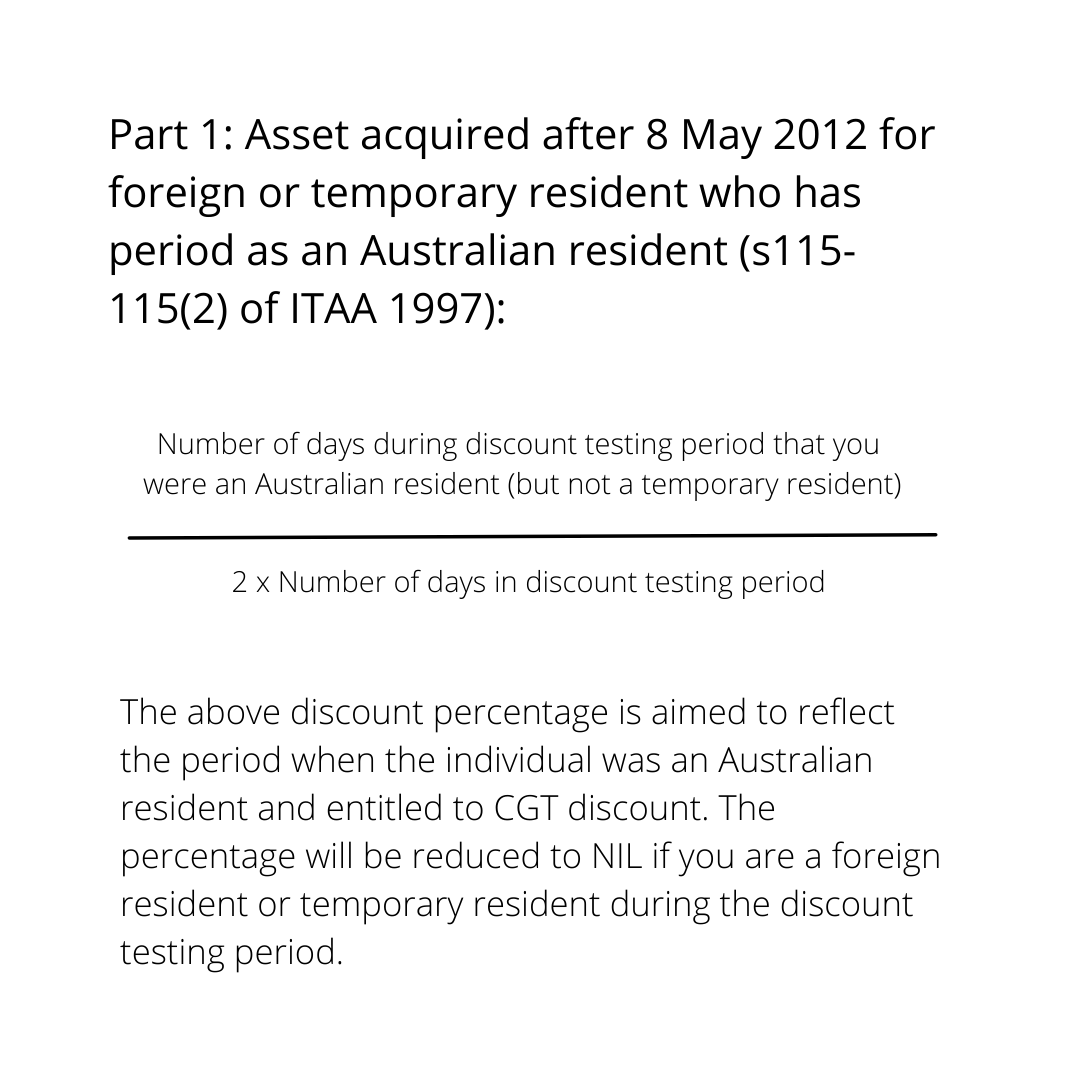

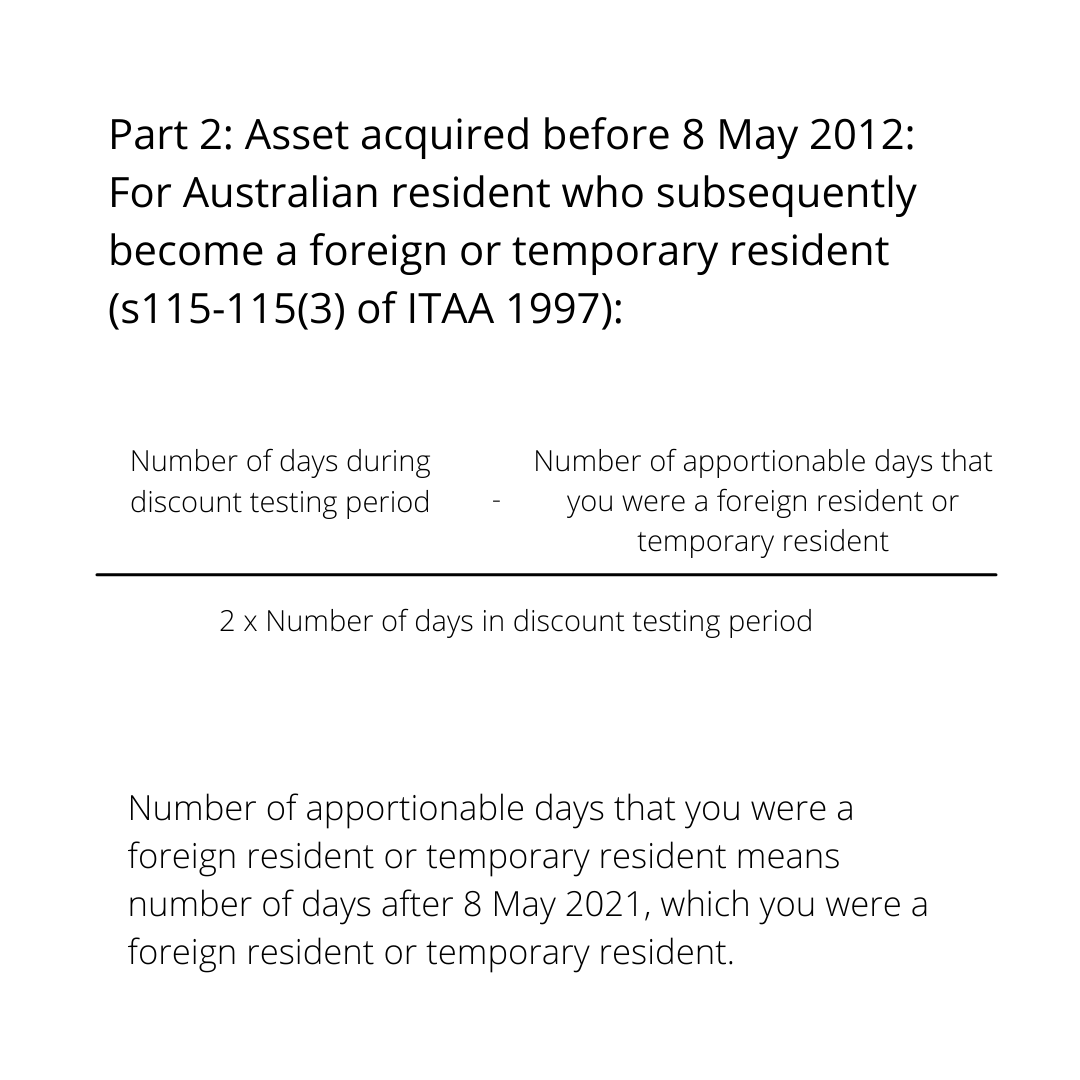

- For asset obtained before 8 May 2012 / you had a period of ordinary resident after 8 May 2012, the capital discount will need to be apportioned accordingly based on the discount testing period formula outlined in S115-115 of ITAA 1997.

There is a discount testing period which is defined as the period when you are entitled to CGT discount due to your tax residency status.

So how do we calculate the discount percentage? See below for which situation applies to you:

Did you know: you may still be able to access part of the CGT discount.

If you were a foreign or temporary resident on 8 May 2012 you can access the CGT discount on the asset up to 8 May 2012 using the market valuation method (s115-115(4) of ITAA 1997).

This valuation method is also subject to the following conditions are met:

- the discount testing period for the discount capital gain starts on or prior to 8 May 2012

- the most recent acquisition of the CGT asset (before the CGT event) happened on or before 8 May 2012

- the market value of the CGT asset at 8 May 2012 was not less than its cost base (ie it had increased in value), and

- you choose to apply the market valuation method instead of other method.

The discount percentage under market valuation will be calculated by determining the excess (i.e. market value of the asset as of 8 May 2012 less the cost base of the asset).

| Item | If the excess is… | Then, the percentage is calculated as… |

| 1 | Equal to or greater than the total CGT discount | 50% |

| 2 | Less than the total CGT discount | To apply formula under s115-115(5) |

What if you chose to apply another valuation method?

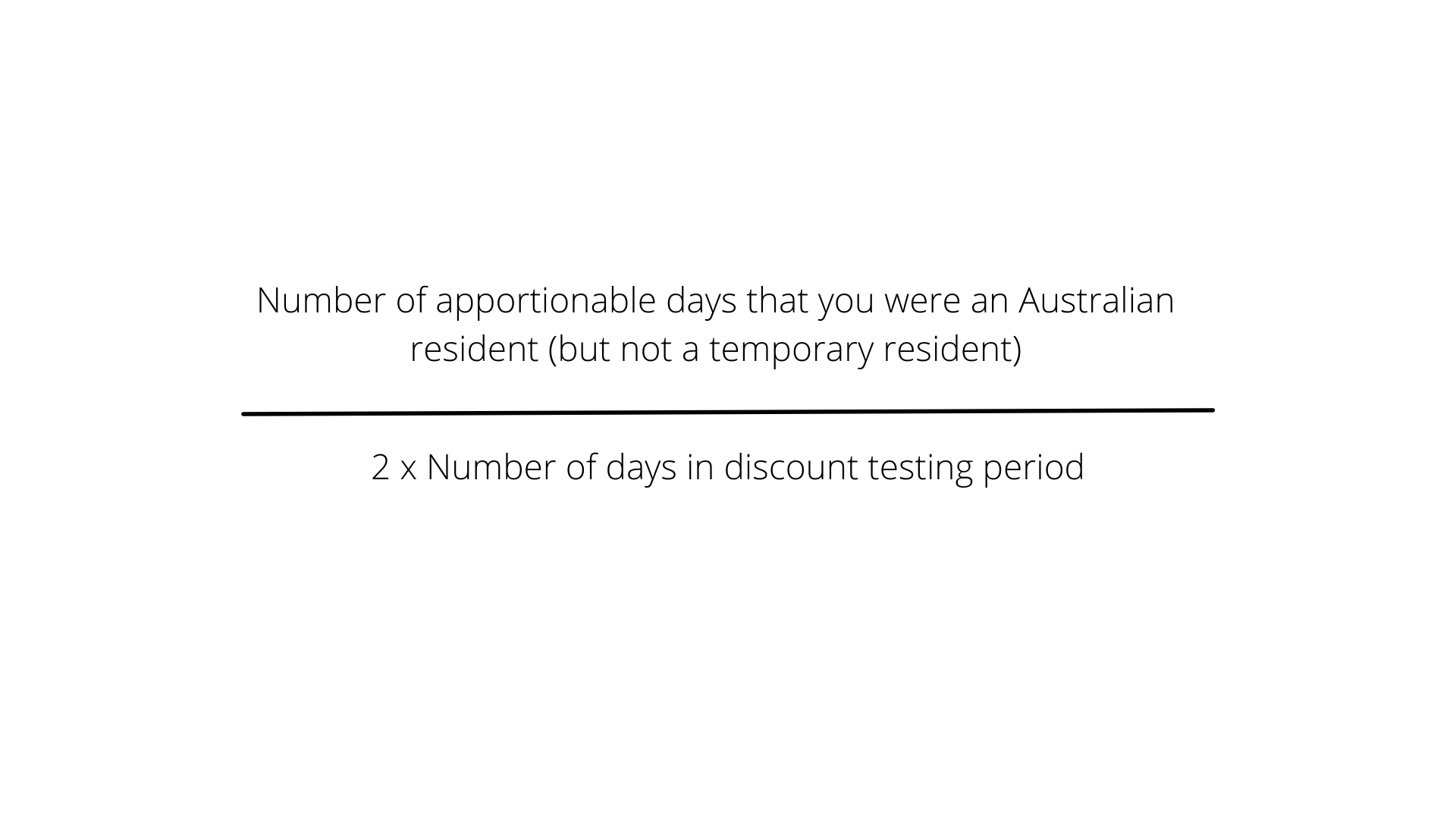

For foreign or temporary residents on 8 May 2012 who choose to apply other valuation method, the CGT discount percentage will be calculated under s115-115(6) of ITAA 1997 as follows:-

The percentage could be reduced to 0% if you were a foreign or temporary resident during the apportionable days period.

Recap:

Generally, there is no CGT discount available for asset obtained and disposed by foreign or temporary resident after 8 May 2012. However, you might be entitled to a portion of the CGT discount if you were an Australian resident (excluding temporary resident) for a period of time while you holding the TAP asset.

If you need help navigating this area please reach out to one of our team.

+61 3 9939 4488